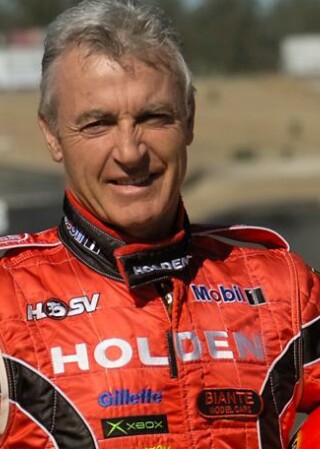

Peter Brock will go down in history. Unfortunately, so too will the story of his Estate. Calm and meticulous in his driving, yet like many Australians, unprepared when he passed away suddenly in 2006.

Brock had 3 “Wills” when he died. One from 1984, another from 2003 and the final in 2006. The 2003 Will was done by way of the DIY Will Kit. In 2006, the story is similar with Brock “filling in the blanks” of a DIY Will Kit without any guidance. The 2006 Will was never signed.

The 1984 Will focused on Brock’s long-time partner, Bev and provided she could live in the family home until the youngest child turned 18, at which stage, the home would pass to the children.

Brock and Bev then separated and Brock re-partnered. The 2003 “Will” named an Executor and provided funeral details. The Will provided no further details of how Brock wanted to gift his Estate. His ex-partner and his assistant witnessed Brock sign the Will. Brock told his ex-partner to “fill in the details”.

The 2006 Will was typed by his assistant at Brock’s direction, two months prior to his death. Brock never got around to signing the Will.

When Brock died in 2006, a lengthy and costly debate ensued over which Will stood. In her testimony to the Court, Bev noted that Brock had a cavalier attitude to anything legal and expressed the view that he would not be around at the time, so he had nothing to worry about. This was not the view of his family and it was them who were left with the burden and uncertainty of his affairs.

Ultimately, the Court found that the 2006 Will was invalid as the Court could not be satisfied that Brock wanted that to be his final Will. The 2003 Will, while it only named Executors and detailed Brock’s funeral arrangements, was found valid. The Court found that the Will revoked the 1984 Will. As the Will left no details as to how Brock’s Estate would be distributed, Brock then had no say on how his Estate would be left, even though he had what he possibly believed to be 3 Wills.

In the end, Brock’s steps to finalise his Estate did not achieve what he wanted, with the DIY Will Kit causing more harm than good. Despite using them, the way his Estate was distributed was left to the NSW legislation and Brock’s wishes were in vain.

Noting Brock’s experience, it is more important than ever, given the nature of blended families and the value of a persons Estate that a Will be correctly and competently drafted. If you have any questions or are considering your own Estate Planning needs, please contact our Estate Planning Solicitor, Krystle Wolthers at kwolthers@marsdens.net.au or on (02) 4626 5077.

The contents of this publication are for reference purposes only. This publication does not constitute legal advice and should not be relied upon as legal advice. Specific legal advice should always be sought separately before taking any action based on this publication.

Peter Brock – The Case of the DIY Will

Want to hear more from us?

Subscribe to our mailing list